Investment Philosophy

Excess returns come from companies that deliver what the market wants.

Investment philosophy refers to the approach an investor takes towards the stock market, encompassing the beliefs and principles that influence their decisions.

Investors generally expect the stocks they purchase to increase in value over time, and investment philosophy explains the reasoning behind this expectation. For instance, Value Investors look for temporarily undervalued stocks, Growth Investors target companies expected to grow, and Momentum Investors aim to capitalize on current stock price trends.

Our investment philosophy is founded on the idea that “reward is a function of performance (of the company) against market expectations.” Therefore, it is crucial to identify companies that are likely to meet or exceed market expectations in order to generate good returns. To make money, it’s important to find companies that can do what the market wants.

Excess returns come from companies that deliver on market expectations.

Quantitative Value Investing

We define “Value” as the probability of the investment to deliver expected returns in the given time period.

Quantitative Value Investing is our innovative approach to implementing our investment philosophy. We believe that “Numbers reveal the true character of the company” and it is upto the investor to decipher this message. First principles of investing are best implemented quantitatively and so is the assessment of the quality of the company for e.g its balance sheet strength, its operational efficiency and consistency, etc.

Quantitative approach ensures that decisions are based on data and data alone. No personal biases or emotions impact the investment decisions. Quantitative methods can be used to design, implement and back test strategies to identify investment opportunities, EVM is one such strategy.

Expectations Value Model

What is EVM ?

EVM is a quantitative model that identifies investment opportunities based on our Investment Philosophy. It establishes a relationship between Intrinsic Value and the Market Expectations.

EVM characterizes a company as combination of three factors: Capital, Returns & Risk, where risk represents variability in returns. This structure allows EVM to consistently value companies from various sectors, whether they are product-centric, such as a paint manufacturer, or service-focused, like an IT services firm. This unified approach helps analyze market expectations and assess their feasibility. The higher the feasibility, the greater the value.

Principle of EVM

3. Systematic investing beats timing the markets. Investing Process is as critical as stock selection.

Why Does EVM Work?

The effectiveness of EVM is rooted more in human psychology than in financial or economic principles.

Consider this, a 10th-grade student who anticipates scoring 50% on their board exam but ends up with 60% feels joy and considers it a success. Conversely, another student who expects to score 90% but only achieves 88% perceives it as a failure. Why does a score of 60% bring more joy and be seen as a greater success than 88%? The explanation for this phenomenon lies at the core of EVM.

Our assessment of performance is influenced by our expectations, and we define success as meeting or exceeding these expectations. Reward is a consequence of success.

In stock market as well, companies that are rewarded typically do so because they have met or exceeded the expectations set before them.

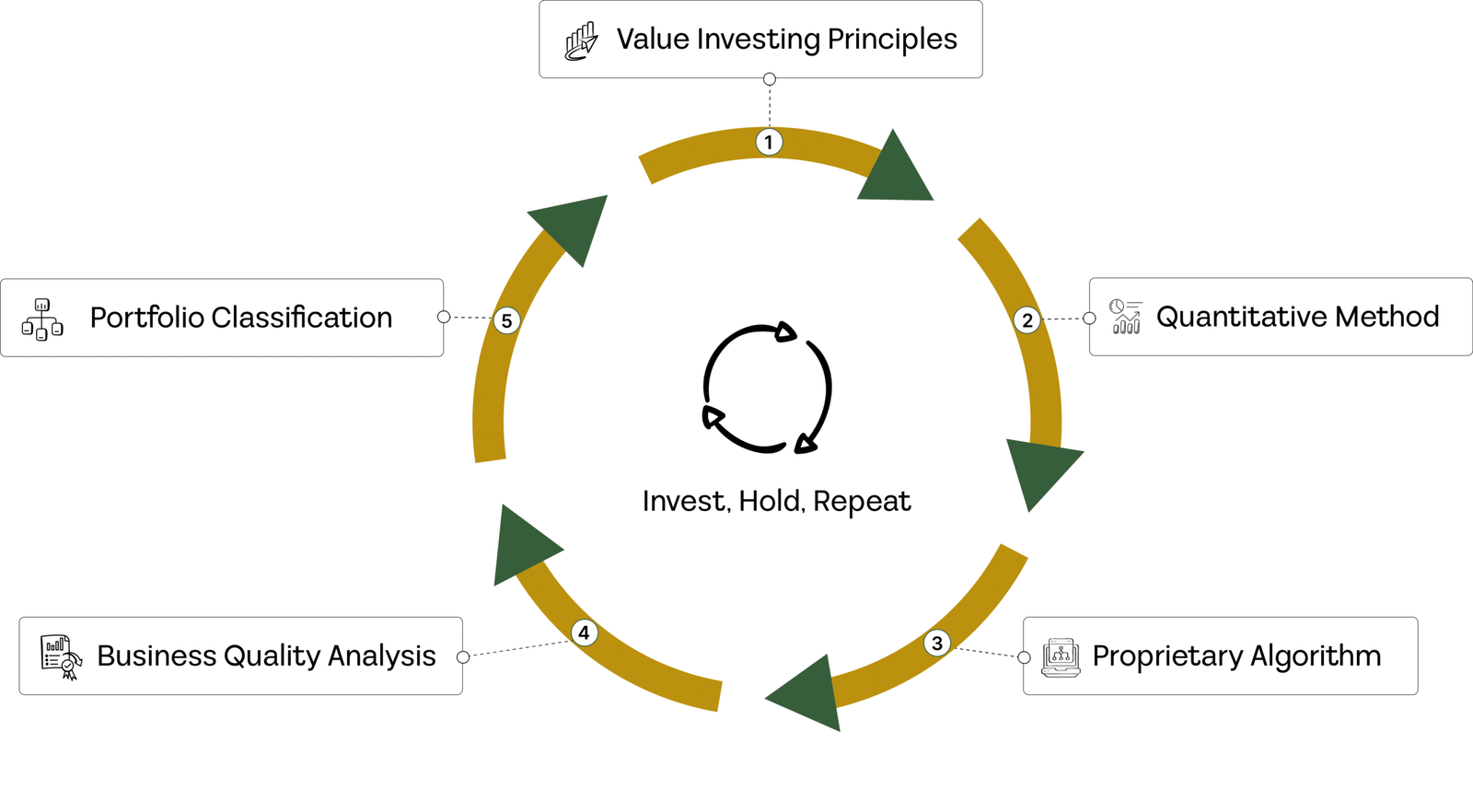

EVM Process

EVM in Action: Streamlining the Investing Journey

Observations That Lead To EVM

Our Journey to EVM

Our exploration of the Expectations Value Model (EVM) began when we recognized that market behavior does not always align with traditional value investing principles. We observed that stocks with low valuations can remain stagnant for extended periods, while those with high valuations often continue to rise or maintain their expensive status.

This raises several questions:

- What influences these stock prices?

- Which types of stocks yield returns that surpass market averages?

- Why do high-priced stocks resist correction, even when optimistic value investing models fail to justify their valuations?

- If the present value of cash flows represents the true worth of stocks, why do overvalued stocks still achieve exceptional returns?

If market dynamics were solely driven by supply and demand, we would expect all stocks to rise uniformly. However, certain stocks consistently outperform others. This trend is particularly evident in the NASDAQ, where a small number of stocks accounted for a significant portion of the index’s growth from 2020 to 2025. Additionally, we noticed that different stocks tend to excel each year, suggesting that holding the same stocks over multiple years could potentially diminish overall returns.

These insights led us to develop the Expectations Value Model, prompting a re-evaluation of what constitutes "value." According to EVM, value is defined by a company's ability to meet market expectations, rather than the traditional approach of calculating the present value of future cash flows. The market, in its collective wisdom, assesses a company's worth based on anticipated earnings, operational efficiency, and overall quality. When companies meet or exceed these expectations, they are rewarded by the market.

With this understanding, we shifted our focus to defining what “expectations” entail and how that can be calculated. This can encompass various factors, including operational profits, cash flows, balance sheet improvements, or a combination of these elements. The methodology we use to derive these expectations is proprietary and forms the crux of our equity analysis.

Once we establish the expectations, the next step is to evaluate their feasibility. We filter companies that are most likely to meet or exceed these expectations, along with traditional business quality criteria to create a probable list for the year. This process can be repeated annually, allowing us to rebalance our portfolio based on the latest results.